Description

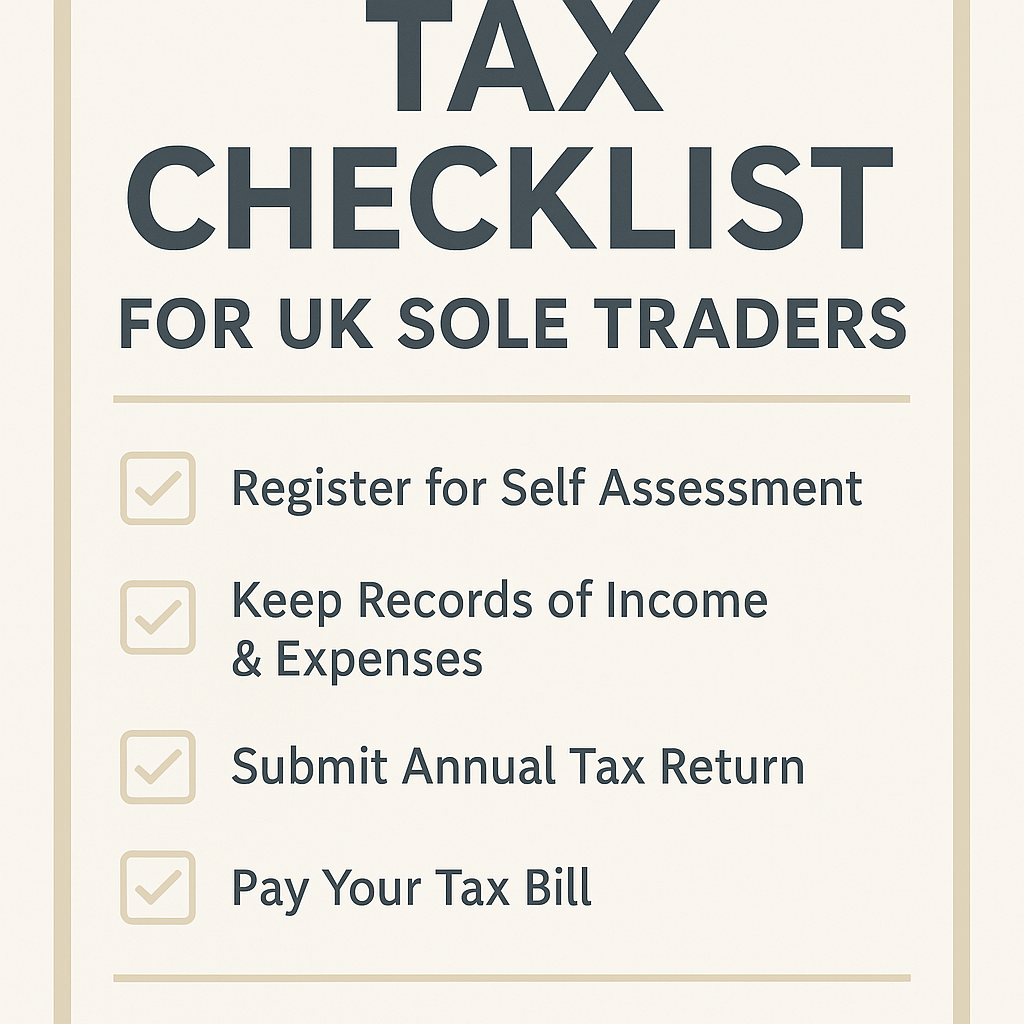

Thank you for downloading the Tax Checklist for UK Sole Traders (2025 Edition) from QuillSmiths Publishing Ltd.

This printable resource has been carefully developed to help UK-based sole traders, freelancers, and consultants stay fully compliant and organised when preparing their Self Assessment tax return for the 2024–2025 tax year.

📌 WHAT’S INCLUDED:

– A step-by-step Tax Checklist (PDF)

– A “How to Use This Checklist” guide

– License.txt outlining permitted usage

Each section of the checklist corresponds to a key stage in the tax return journey:

1. Registration and Setup

2. Bookkeeping and Monthly Tracking

3. Claiming Allowable Business Expenses

4. Preparing for Submission

5. Completing and Filing Your Return

6. Post-Submission Actions

7. Bonus: Making Tax Digital Readiness

🧠 TIP: This checklist is a helpful companion, but it does not replace official tax advice. Always consult a qualified accountant or HMRC for guidance specific to your business.

📫 NEED HELP?

Email: Support@QuillSmiths.com

or

Visit https://www.QuillSmiths.com for more digital tools, checklists, and business resources for UK sole traders.

Thank you for supporting independent publishing.

— The QuillSmiths Team

Reviews

There are no reviews yet.